Best Accounting System for Restaurants in the UAE and Beyond

Why You Need Accounting Software Built for Restaurants?

Restaurants run on numbers: from sales to inventory, payroll, and purchases. Spreadsheets and legacy systems can’t keep up, and even popular accounting tools like QuickBooks, Zoho, or Xero often struggle to integrate with restaurant operations. The result? Teams waste time consolidating data instead of acting on it.

An accounting system built specifically for restaurants connects POS, inventory, purchases, and payroll in real time. That means you see revenue, expenses, and cash flow instantly, so you can make decisions that save costs and boost profits, anytime, anywhere.

Top 12 Must-Have Features of Restaurant Accounting Software

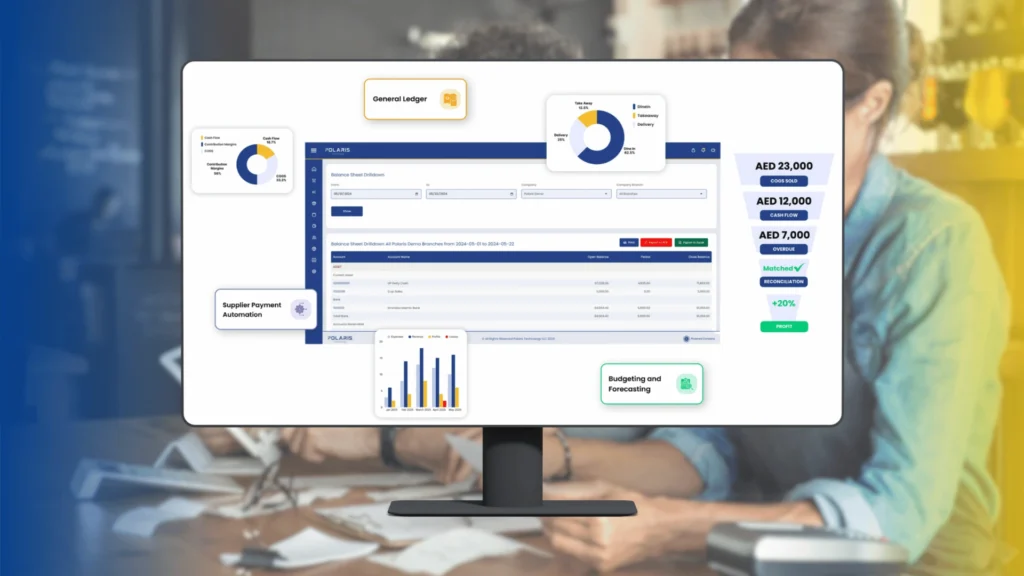

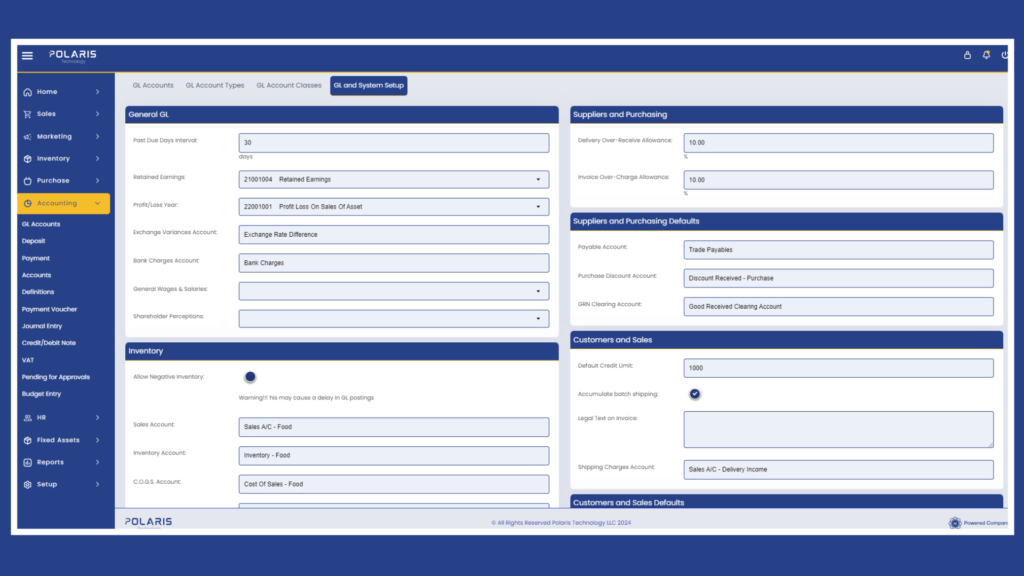

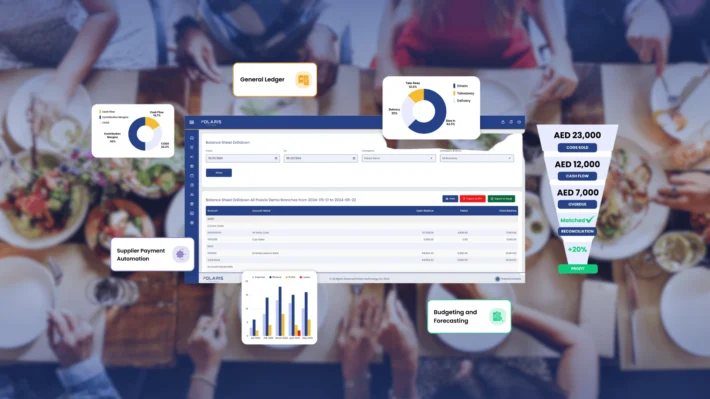

1. General Ledger (GL)

In Polaris ERP’s restaurant accounting system, the general ledger inquiry report provides a comprehensive overview of general ledger transactions within a specified time period. This powerful tool allows restaurant owners and managers to filter and analyze transactions based on GL accounts, dates, or company branches.

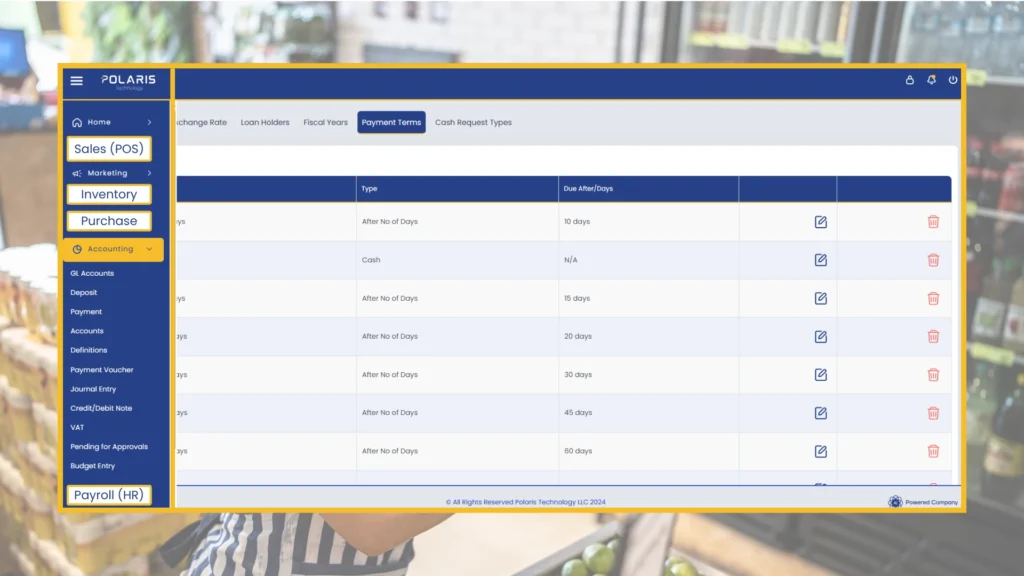

2. Advanced Accounts Payable and Receivable

Manage supplier payments and customer balances effortlessly. The best accounting system for restaurants tracks every invoice, sends automated reminders, and provides real-time visibility into your cash flow, helping you stay on top of payables and receivables without the stress of manual follow-ups or errors.

3. Recipe Costing (Food Cost Calculator)

The best restaurant accounting system needs to connect with inventory to calculate recipe costs automatically. In an advanced system like Polaris ERP, cost of goods sold (COGS) updates in real time, accounting for supplier changes or fluctuating prices, so you always know the true cost of every dish.

4. Bulk Supplier Invoices Payment

This feature lets restaurants consolidate multiple supplier invoices and pay them all at once, saving time and reducing errors. Instead of processing each invoice individually, you can schedule bulk payments, track which invoices have been paid, and maintain accurate records in real time. Polaris ERP also ensures that your cash flow is updated automatically, helping you stay on top of expenses and avoid missed or duplicate payments.

5. Bank Reconciliation & Cash Management

Bank reconciliation automatically matches your restaurant’s accounting records with bank statements, helping catch errors or missing transactions. Cash management tracks inflows and outflows, giving a clear view of available cash. Advanced accounting systems like Polaris ERP also break down cash flow by operating, investing, and financing activities, so you know exactly where your money is coming from and going to.

6. Profit and Loss Drilldown

A P&L statement summarizes your sales and expenses to show whether your restaurant is making a profit or running at a loss. With a restaurant SaaS like Polaris ERP, revenue and expenses are automatically connected, giving you accurate P&L reports for any period (daily, weekly, monthly, or yearly) so you can make timely, informed decisions.

7. Consolidated Financial Reporting

Financial Reporting compiles all company data into structured reports, showing where money comes from, where it’s spent, and the overall health of the business. For multi-branch F&B operations, it generates combined reports across branches while also breaking down sales by menu category, food and labor costs, and waste. With the best restaurant accounting software solution, these insights are delivered in real time.

8. Tax Compliance

Managing VAT and other taxes can get messy, especially with multiple branches and suppliers. An accounting system designed for restaurants automates tax calculations, generates accurate reports, and keeps records audit-ready, helping restaurants stay compliant and avoid costly errors.

9. POS Connectivity

Connectivity with the POS is essential for accurate sales tracking. Third-party integrations can be unreliable, often causing mismatched data because the accounting system and POS don’t “speak the same language.” With a restaurant ERP, both systems exist in the same environment, sharing data seamlessly in real time.

10. Multi-Branch Support

As restaurants grow, it’s crucial for an accounting system to capture financial data from all locations. Traditional systems often require separate integrations with each branch’s POS, creating complexity and potential errors. With a restaurant SaaS like Polaris ERP, every branch is pre-defined in the system and automatically connected to its POS, so sales, expenses, and financial reports are updated in real time across all locations.

11. Budgeting and Forecasting

Standard accounting systems struggle with real-time forecasting because POS, inventory, purchase, and payroll data must be collected and uploaded manually, often causing errors. A restaurant accounting system like Polaris ERP forecasts demand accurately by analyzing past sales, inventory needs, and staffing requirements for shifts, as all systems are native. These real-time insights help planning purchases, schedules, and budgets without guesswork.

12. User Access & Security

Restaurants are vulnerable to theft, fraud, and accidental errors. With role-based user access, a restaurant accounting system like Polaris ERP ensures each team member sees only what they need, protecting sensitive financial data and reducing the risk of fraud or mistakes.

Benefits of an All-in-One Restaurant SaaS with Built-In Accounting System

In a restaurant SaaS environment, financial reporting is automated, and data from sales, purchases, inventory, and HR flows directly into the accounting system. This seamless connection saves time and ensures that all financial records are up to date without manual entry.

- Minimized human error

Automation also reduces mistakes. By automatically tracking and reporting financial data, a restaurant SaaS with built-in accounting lowers the risk of errors that can occur when reconciling sales, inventory, or payroll manually.

- Scalability

Whether you’re running a single location or expanding into multiple branches or cloud kitchens, an all-in-one system scales with your business. It can manage all outlets from one platform, keeping financials, inventory, and operations synchronized across locations.

With real-time insights into daily P&L, inventory levels, and cash flow, managers can make faster, smarter decisions. Immediate visibility into key metrics helps optimize operations and respond quickly to changes in demand or costs.

- Regulatory compliance

A built-in accounting system ensures VAT, labor laws, and financial reporting requirements are automatically handled and localized. This reduces compliance risks and helps restaurants stay audit-ready without extra effort.

- Save money with the best accounting system for restaurants

Using separate systems for POS, accounting, purchasing, and inventory can quickly add up, creating hidden costs and inefficiencies. When using a restaurant SaaS solution that includes accounting and all other systems necessary in an F&B environment, you end up saving significantly.

How to Get Started with the Best Restaurant Accounting System

Switching from a standard accounting system or a spreadsheet-based accounting system to a restaurant accounting system that is part of an ERP can seem frightening and expensive. Despite the common perception, not all systems are as costly as Oracle or Microsoft. Especially when talking about restaurant ERP systems built with the restaurant environment in mind, you will see for yourself that it’s worth the investment.

To get started with a restaurant accounting system, research the best solutions on the market. Make sure they offer the top 12 benefits suggested in this blog. When you’re not sure if they do, simply schedule a meeting.

You can start here by scheduling a free 30–60 minute consultation and demo with our team to see Polaris ERP’s restaurant accounting system in action.

You May also Be Interested in:

Ready to start saving time and costs with the best financial system for restaurants?

Book a free demo

2 Comments

Comments are closed.

[…] a natively connected HR system, like Polaris ERP, all payroll and staff data flows automatically into accounting. This ensures accuracy, saving managers hours of work, and giving a clear, real-time view of labor […]

[…] inventory, and accounting stay aligned, without manual syncing, which is often exposed to human […]